Health and Life insurance to improve your health, wellbeing, and Provide peace of mind.

At Trent Advisors, we advise with integrity to help our clients find the best insurance solutions possible for themselves and their families.

Contact an Agent

Call: (352) 855-0525

HEALTH insurance

We help our clients navigate the complexities of health insurance. We help them find a plan that fits their needs in what it delivers and in cost. Your best interests are always top of mind.

LIFE insurance

It is important to think about your legacy when planning for your future. Will your family be okay tomorrow if something were to happen to you today? Protect your family’s financial future.

Travel insurance

Often overlooked, travel insurance is more than just a “nice-to-have” luxury. Safeguard your trip if something is to happen to you, your property, or your itinerary. Travel insurance can help.

A Full Spectrum of Solutions

The experts at Trent Advisors specialize in helping their clients navigate the complexities of health insurance, life insurance, Medicare, vision and dental insurance, and travel insurance. Don’t face it alone. We are here to help you!

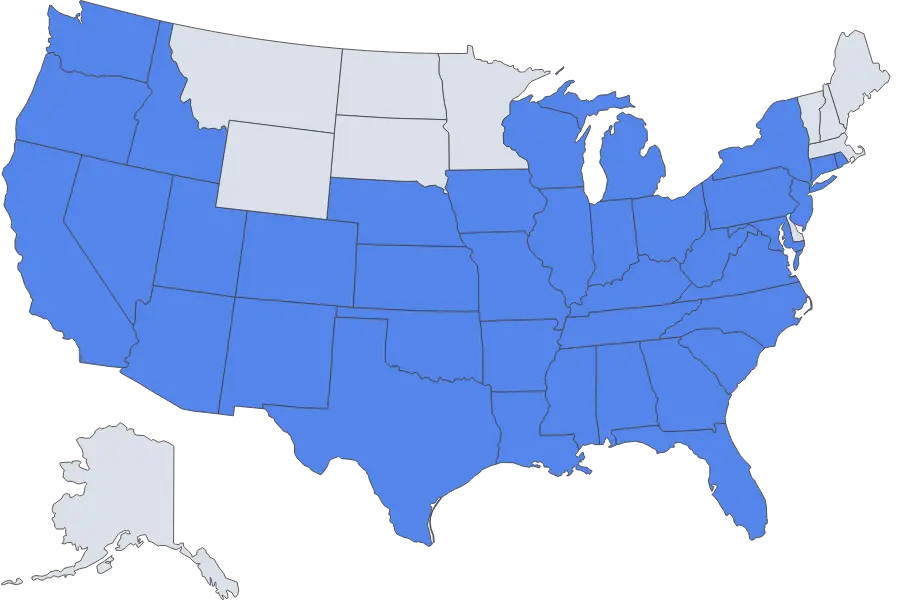

Helping Families in 35+ States

Trent Advisors is dedicated to helping people no matter where you call home. We are currently licensed in 30+ states and are in the process of gaining more. Our mission is to be our clients’ advocate and to guide them to create better solutions that protect them against risk, preserve themselves, and preserve their assets financially.

ADVISORY with integrity

Are you looking for health insurance experts who have your best interest in mind? Trent Advisors pride themselves in leading with integrity to provide the best possible solutions to our clients.

Insurance Quotes

Insurance Quotes

Insurance Quotes

Insurance Quotes

Insurance Quotes

Insurance Quotes